Flow Actions Transaction

We are reviewing and finalizing Flow Actions in FLIP 339. The specific implementation may change as a part of this process.

We will update these tutorials, but you may need to refactor your code if the implementation changes.

Staking is a simple way to participate in the blockchain process. You supply tokens to help with governance and, in return, you earn a share of the network's rewards. It's a way to grow unused assets and provides a much higher rate of return than a savings account.

Make certain you understand how slashing works and assess your risk tolerance before you stake.

To stake directly, lock up your tokens with Flow Port. You can also use other platforms and protocols that have a different strategy for participating in this process. IncrementFi offers a Liquid Staking Protocol (LSP) they describe as:

LSP allows users to earn staking rewards without locking $flow tokens or running node softwares. Users can deposit $flow tokens and receive transferrable $stFlow tokens in return. Liquid staking combines the benefits of staking (earning rewards) and brings liquidity, as well as additional possibilities to increase your assets or hedge your positions by participating in Flow's DeFi ecosystem.

Participation in staking comes with a tedious chore - you'll need to regularly complete one or more transactions to claim your rewards and restake them to compound your earnings.

Flow Actions simplifies this task. It gives you a suite of blocks that, after instantiation, perform actions in the same way from one protocol to another.

In this tutorial, you'll learn how to build a transaction that simplifies restaking on IncrementFi, and that you can adapt with different connectors to work on other protocols as well.

If you combine this transaction with scheduled transactions, you can automate it completely!

Learning objectives

After you complete this tutorial, you will be able to:

- Chain multiple decentralized finance (DeFi) operations atomically

- Handle token type mismatches automatically

- Build safe, validated transactions with proper error handling

- Create reusable, protocol-agnostic DeFi building blocks

Prerequisites

- Flow CLI: install from the Flow CLI docs

- Cursor + Cadence Extension (recommended)

Cadence programming language

This tutorial assumes you have a modest knowledge of Cadence. If you don't, you can still follow along, but we recommend that you complete our series of Cadence tutorials. Most developers find it more pleasant than other blockchain languages and it's easy to pick up.

Get started on mainnet

This demo uses mainnet and a real DeFi protocol. Before you write any code, set up your staking position.

This tutorial uses a real protocol with real funds. Only work with funds your comfortable losing in the event of an error or mistake. Cadence is much safer than Solidity, you can make a mistake and all investment involves risk.

Stake with IncrementFi

To complete this tutorial, set up a staking position in Increment Fi. If you already have LP tokens, skip to the Staking LP Token step.

Create an LP position

First, go to the Increment Fi Liquidity Pool and select 'Single Asset' to provide liquidity with your FLOW tokens.

Then, enter the amount of FLOW you want to add as liquidity. Confirm the transaction and continue to the next step.

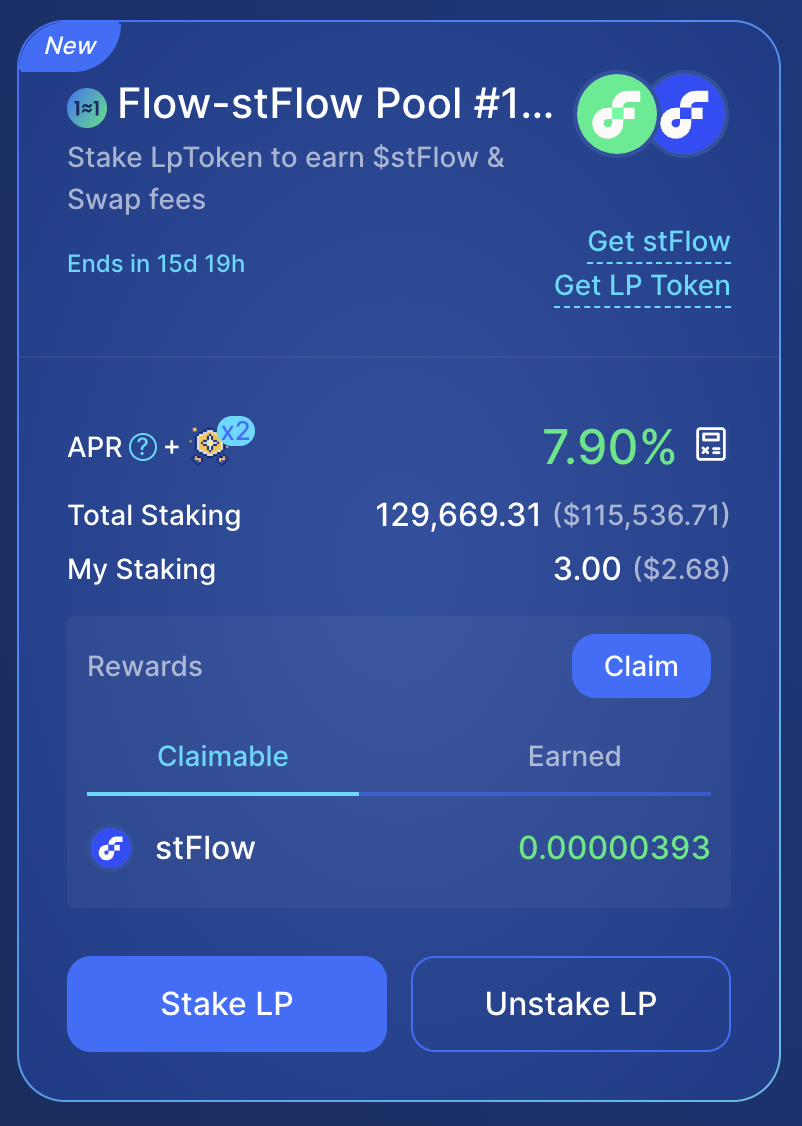

Staking LP token

Now that you have LP tokens from the FLOW-stFLOW pool, you can stake these tokens to receive rewards from them. To do this, go to the IncrementFi Farms page and look for the Flow-stFlow Pool #199 pool. Note that the #199 is the Pool ID (pid). You might need to select the list view first (the middle button in the upper-right section of the LP pools page) in order to properly see the pid.

This pid is necessary to execute the restaking transaction later, so make certain you know which pid to use.

Then, select Stake LP and enter the amount of LP tokens to stake into the pool. After the transaction is approved and confirmed, you will see the total stake position and claimable rewards in the pool card.

Now our staking position generates rewards as time passes by. We use Flow Actions to execute a single transaction that can claim the rewards (stFLOW), convert the optimal amount into FLOW, increase the LP position (thus getting more LP tokens), and restake them into the farm.

Initialize Your Staking.UserCertificate

IncrementFi uses a Staking.UserCertificate internally for some actions, and you'll need this certificate to complete this tutorial. While the platform automatically creates it when you perform other actions on the platform, you can explicitly set it up with the script on Flow Runner.

When the transaction succeeds, you'll see output similar to:

_10Transaction ID: 7d3efabb98d3fed69aabf8fa9007fa11571b70300cbd641120271bbfa8e932f5_10Transaction Result:_10{6 items_10"blockId":string"1206e0a1e6f16098e8d3555f7568f7f14e8e6df1983946408627a964dd87d69d"_10"status":int4_10"statusString":string"SEALED"_10"statusCode":int0_10"errorMessage":string""_10# Remaining details omitted for brevity

The UserCertificate is a resource stored in your account's private storage that:

- Proves your identity for IncrementFi staking operations.

- Allows you to claim rewards from staking pools.

Set up the project

To start, use the Flow Actions Scaffold repo as a template to create a new repository. Clone your new repository and open it in your editor.

Follow the instructions in the README for mainnet.

Start With the scaffold

Create a new repo with the Flow Actions Scaffold as a template. Clone your new repo locally and open it in your editor.

Run flow deps install to install dependencies.

This Scaffold repo is a minimal Flow project with dependencies for Flow Actions and Increment Fi connectors. It only has support for the specific transaction that we execute in this demo (Claim → Zap → Restake for IncrementFi LP rewards)

Export Your wallet key

Never use a wallet with with a large amount of funds for development! If you download a malicious VS Code extension, your funds could be stolen.

Never put a wallet key directly in flow.json.

Transactions on mainnet incur fees and affect onchain balances. We recommend that you create a new Flow Wallet account with limited funds.

Export the key for the wallet you want to use for this exercise. It needs to have some funds in it, but you shouldn't do development with the same wallet you keep any valuable assets in.

Create a .pkey file for your wallet key, add it to .gitignore, then add the account to flow.json:

_10"accounts": {_10 "my-testing-account": {_10 "address": "<YOUR CADENCE ADDRESS>",_10 "key": {_10 "type": "file",_10 "location": "./my-testing-account.pkey"_10 }_10 }_10}

Build the transaction

Now that the dependencies have been properly setup and we have made sure that our account is properly setup, the staking position is established as well as the Staking.UserCertificate; we are now ready to finally build the restaking transaction

We will be duplicating the transaction provided in the scaffold cadence/transactions/increment_fi_restake.cdc

The key pattern we need to create is:

Source → Swap → Sink

- Source: Provides tokens (rewards, vaults, etc.)

- Swap: Converts tokens (swapping to zap input then zapping to LP tokens)

- Sink: Receives and deposits tokens (staking pools, vaults)

Import required contracts

First, import all the contracts you need to build the transaction:

_10import "FungibleToken"_10import "DeFiActions"_10import "SwapConnectors"_10import "IncrementFiStakingConnectors"_10import "IncrementFiPoolLiquidityConnectors"_10import "Staking"

FungibleToken: Standard token interface for FlowDeFiActions: Core Flow Actions framework for composabilitySwapConnectors: Wraps swap operations as Flow ActionsIncrementFiStakingConnectors: Flow Actions connectors for IncrementFi stakingIncrementFiPoolLiquidityConnectors: LP token creation (zapping)Staking: Core staking contract for user certificates

Define transaction parameters

We will specify the pid (Pool ID) as the transaction parameter because it identifies which IncrementFi staking pool to interact with

_10transaction(_10 pid: UInt64_10) {

Declare transaction properties

Then, declare all the properties needed for the transaction. Here is where you'll use the Staking.UserCertificate for authentication staking operations. The pool is used to reference the staking pool for validation. The starting balance for post-condition verification is the startingStake. The composable source that provides LP tokens is the swapSource. The expectedStakeIncrease is the minimum expected increase for safety. Finally, the operationID serves as the unique identifier for tracing the operation across Flow Actions.

_10let userCertificateCap: Capability<&Staking.UserCertificate>_10let pool: &{Staking.PoolPublic}_10let startingStake: UFix64_10let swapSource: SwapConnectors.SwapSource_10let expectedStakeIncrease: UFix64_10let operationID: DeFiActions.UniqueIdentifier

Prepare phase

The prepare phase runs first in the transaction. You use it to set up and validate a Cadence transaction. It's also the only place where a transaction can interact with a user's account and the [resources] within.

Pool Validation verifies that the specified pool exists and is accessible.

_10// Get pool reference and validate it exists_10self.pool = IncrementFiStakingConnectors.borrowPool(pid: pid)_10 ?? panic("Pool with ID \(pid) not found or not accessible")

User State Validation records current staking balance to verify the transaction worked correctly.

_10// Get starting stake amount for post-condition validation_10self.startingStake = self.pool.getUserInfo(address: acct.address)?.stakingAmount_10 ?? panic("No user info for address \(acct.address)")

User Authentication creates a capability to access your UserCertificate (required for staking operations)

_10// Issue capability for user certificate_10self.userCertificateCap = acct.capabilities.storage_10 .issue<&Staking.UserCertificate>(Staking.UserCertificateStoragePath)

Operation Tracking creates a unique ID to trace this operation through all Flow Actions components

_10// Create unique identifier for tracing this composed operation_10self.operationID = DeFiActions.createUniqueIdentifier()

Token type detection and configuration

Use the pid from the pool we staked the LP tokens to get the liquidity pair information (what tokens make up this pool). We also convert token identifiers to actual Cadence types and determines if this is a stableswap pool or a regular AMM.

_10// Get pair info to determine token types and stable mode_10let pair = IncrementFiStakingConnectors.borrowPairPublicByPid(pid: pid)_10 ?? panic("Pair with ID \(pid) not found or not accessible")_10_10// Derive token types from the pair_10let token0Type = IncrementFiStakingConnectors.tokenTypeIdentifierToVaultType(pair.getPairInfoStruct().token0Key)_10let token1Type = IncrementFiStakingConnectors.tokenTypeIdentifierToVaultType(pair.getPairInfoStruct().token1Key)

Build the Flow Actions chain

We need to create the RewardsSource so that we can claim the available rewards from the staking pool.

_10// Create rewards source to claim staking rewards_10let rewardsSource = IncrementFiStakingConnectors.PoolRewardsSource(_10 userCertificate: self.userCertificateCap,_10 pid: pid,_10 uniqueID: self.operationID_10)

In case the reward token might not match the pool's token0, we check if we need to reverse the order to account for this mismatch. This helps us verify that the zapper can function properly.

_10// Check if we need to reverse token order: if reward token doesn't match token0, we reverse_10// so that the reward token becomes token0 (the input token to the zapper)_10let reverse = rewardsSource.getSourceType() != token0Type

Now the zapper can function properly and it takes the reward token as an input (regardless of token ordering). The zapper swaps half to the other token pair to combine them into LP tokens.

_10// Create zapper to convert rewards to LP tokens_10let zapper = IncrementFiPoolLiquidityConnectors.Zapper(_10 token0Type: reverse ? token1Type : token0Type, // input token (reward token)_10 token1Type: reverse ? token0Type : token1Type, // other pair token_10 stableMode: pair.getPairInfoStruct().isStableswap,_10 uniqueID: self.operationID_10)

Here is where the true composition of Flow Actions come into place. The lpSource creates a single source that claims rewards from the staking pool. automatically converts them into LP tokens, and provides LP tokens as output.

_10// Wrap rewards source with zapper to convert rewards to LP tokens_10let lpSource = SwapConnectors.SwapSource(_10 swapper: zapper,_10 source: rewardsSource,_10 uniqueID: self.operationID_10)

Then the minimum LP tokens we expect to receive are calculated for safety validation.

_10// Calculate expected stake increase for post-condition_10self.expectedStakeIncrease = zapper.quoteOut(_10 forProvided: lpSource.minimumAvailable(),_10 reverse: false_10).outAmount

Post-condition safety check

This phase runs at the end for condition verification. We verify that the transaction actually increased your staking balance as expected.

_10post {_10 // Verify that staking amount increased by at least the expected amount_10 self.pool.getUserInfo(address: self.userCertificateCap.address)!.stakingAmount_10 >= self.startingStake + self.expectedStakeIncrease:_10 "Restake below expected amount"_10}

Execute the transaction

poolSink creates the staking pool sink in which the LP tokens are deposited.

_10// Create pool sink to receive LP tokens for staking_10let poolSink = IncrementFiStakingConnectors.PoolSink(_10 pid: pid,_10 staker: self.userCertificateCap.address,_10 uniqueID: self.operationID_10)

Now we have all the components ready for the full flow of transactions. swapSource.withdrawAvailable() triggers the entire Source → Transformer chain. This claims rewards, swaps to LP tokens and withdraws LP tokens. The poolSink.depositCapacity() deposits LP tokens into the staking pool. And finally, we verify that all tokens were properly deposited (no dust left behind) and destroy the empty vault.

_10// Withdraw LP tokens from swap source (sized by sink capacity)_10let vault <- self.swapSource.withdrawAvailable(maxAmount: poolSink.minimumCapacity())_10_10// Deposit LP tokens into pool for staking_10poolSink.depositCapacity(from: &vault as auth(FungibleToken.Withdraw) &{FungibleToken.Vault})_10_10// Ensure no residual tokens remain_10assert(vault.balance == 0.0, message: "Residual after deposit")_10destroy vault

See what happened? We executed this whole (and quite complex) flow in an atomic manner with a single transaction!

Run the transaction

We are now ready to restake the position with a single transaction!

_10flow transactions send cadence/transactions/increment_fi_restake.cdc \_10 --network mainnet \_10 --signer my-testing-account \_10 --args-json '[{"type":"UInt64","value":"<YOUR_POOL_PID>"}]'

Replace <YOUR_POOL_PID> with your actual pool ID (PID) from the IncrementFi Farms page, in this case it is 1999. The PID changes over time.

Interpret the results

After you complete the transaction, you see that the following events occurred:

- The rewards (stFLOW) were claimed from pool #199 (or the current pool number if you run this exercise yourself) and the reward balance was updated properly.

- The stFLOW was converted to FLOW.

- FLOW and stFLOW was used to add liquidity to the liquidity pool.

- LP tokens were received.

- LP tokens were staked back into the #199 pool causing the staking balance to increase.

Run the transaction on emulator

You can run this whole transaction on Emulator as well. Although this example used a real pool to demonstrate a real-world use case, we recommend you start any real projects by testing on the Emulator. After cloning the Flow Actions Scaffold and installing the dependencies you can run:

_10make start

The make start command handles all setup automatically using the built-in emulator service account, so no manual configuration is needed. This starts the Flow Emulator and deploys Increment FI dependencies, creates test tokens (1M each), sets up the liquidity pool, sets up the staking pool #0 and displays the complete environment summary. The pid is 0 because the automated setup creates the first staking pool with ID 0 containing your staked LP tokens and active rewards

Now you can test the restake workflow:

_15# Check available rewards_15flow scripts execute cadence/scripts/get_available_rewards.cdc \_15--network emulator \_15--args-json '[{"type":"Address","value":"0xf8d6e0586b0a20c7"},{"type":"UInt64","value":"0"}]'_15_15# Run the restake transaction_15flow transactions send cadence/transactions/increment_fi_restake.cdc \_15--signer emulator-account \_15--network emulator \_15--args-json '[{"type":"UInt64","value":"0"}]'_15_15# Verify rewards were claimed and restaked_15flow scripts execute cadence/scripts/get_available_rewards.cdc \_15--network emulator \_15--args-json '[{"type":"Address","value":"0xf8d6e0586b0a20c7"},{"type":"UInt64","value":"0"}]'

If you want to run Cadence tests, then use the following commands:

_10make test_10# or directly:_10flow test

Conclusion

This transaction demonstrates how to chain multiple DeFi operations atomically, handle token type mismatches automatically, build safe validated transactions with proper error handling, and create reusable protocol-agnostic DeFi building blocks. You can apply these patterns to build yield farming, arbitrage, and portfolio management strategies across Flow's DeFi ecosystem. Flow Actions allow sophisticated DeFi strategies, that are complex in nature and dependant on various protocols, to execute in a single atomic transaction.